Engaging in healthcare professions can be highly financially rewarding, particularly for physicians who can accumulate substantial earnings while actively contributing to the well-being of others. However, as individuals with high incomes, these professionals also contend with significant expenditures, primarily in the form of substantial tax responsibilities incurred throughout the year. Coupled with the repayment of substantial educational debts, this can severely restrict their financial flexibility.

Fortunately, there are approaches to alleviate these financial burdens, even within the confines of a high tax bracket. The following sections will delve into various tax planning strategies designed to assist physicians and other high-income medical professionals in safeguarding a significant portion of their hard-earned income for the future.

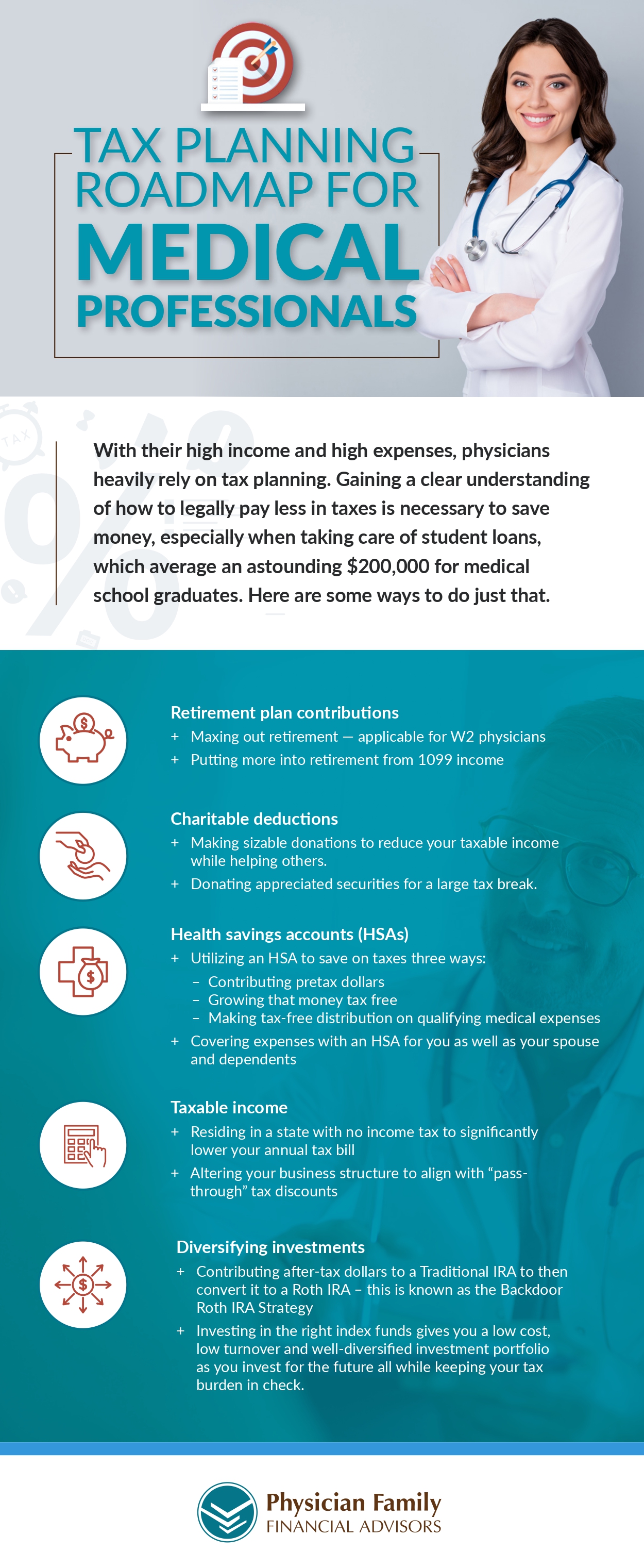

Infographic created by Physician Family Financial Advisors, financial services for physicians.