826 Views

Day traders rely on the Average True Range (ATR) to measure market volatility and decide on stop-loss and take-profit levels. ATR gives a solid idea of how much an asset’s price typically fluctuates over a set timeframe, helping traders tailor their strategies to current market conditions.

By using ATR in their analysis, traders can fine-tune risk management, tweak their position sizes, and maneuver through intraday price changes more accurately and confidently.

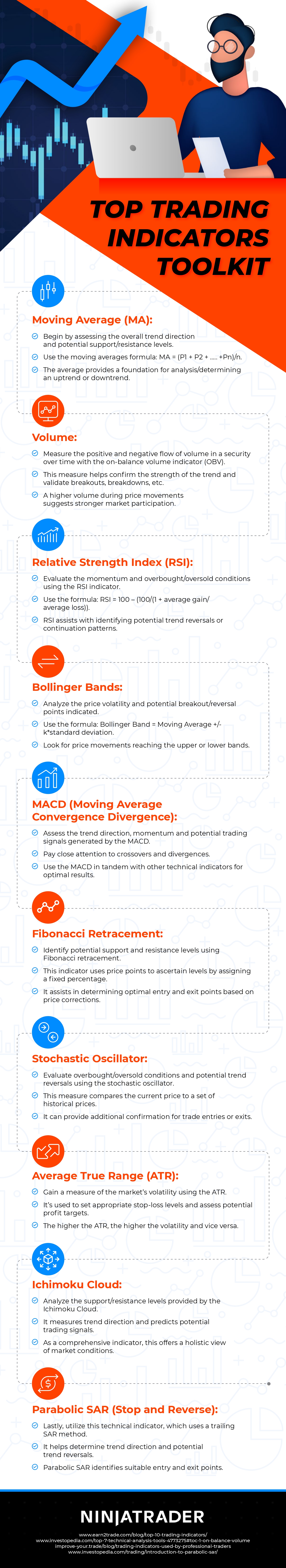

To learn more about ATR and other useful trading indicators, please continue reading on to the resource accompanying this post.

Top Trading Indicators Toolkit, provided by NinjaTrader, where to buy a futures contract